Risk Commercial Services

Risk Commercial Services

Connect and forge new relationships with FX markets traders and industry peers

Empower your brand with integrated commercial capabilities

Risk.net's distinct commercial capabilities can drive your brand's success. From managing and mitigating risks to

facilitating risk transfer, Risk.net's audience includes the most influential and senior risk specialists in the capital markets

Reasons to partner with us

Position your organisation as a thought leader

Receive the latest market intelligence

Meet, network and forge partnerships

Discuss trends impacting the industry

Elevate your brand presence in the risk space

Reach senior decision-makers

Connect and forge new relationships with FX markets traders and industry peers

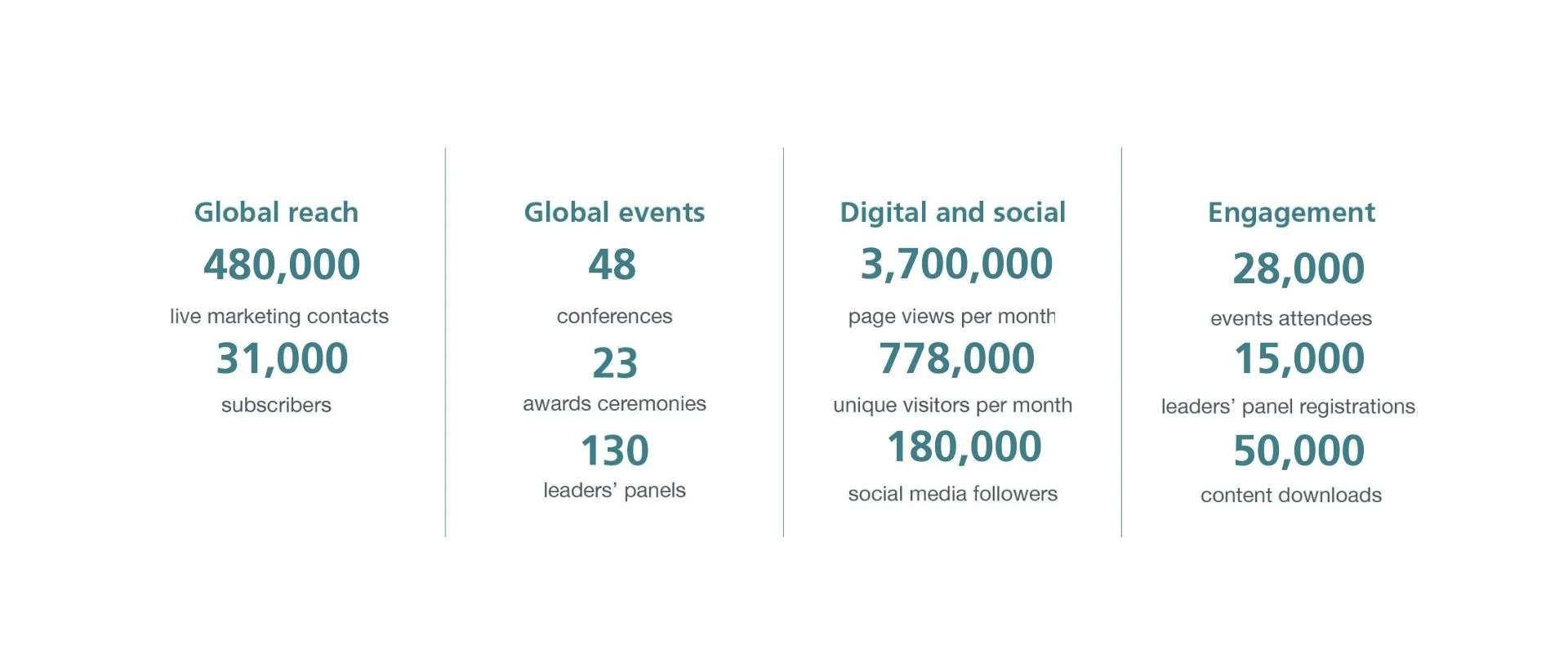

Our audiences

Breakdown by region

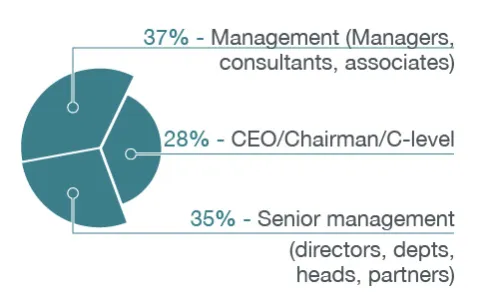

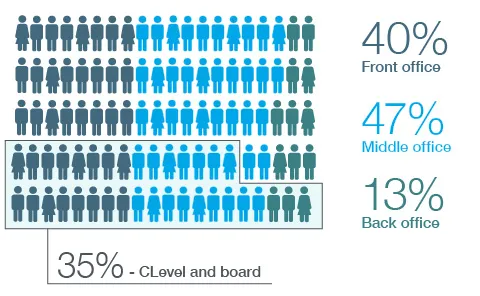

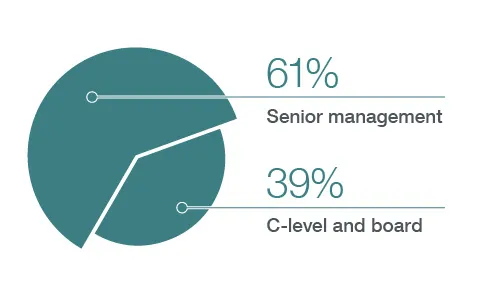

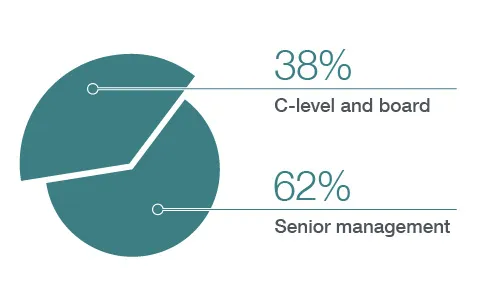

Seniority breakdown

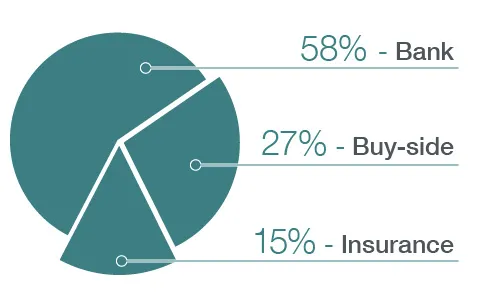

Industry breakdown

Banks

Investment management companies, hedge funds, pension funds and asset managers

Life Insurance

Ways to reach your buyers and influencers

Content

Our in-house content studio can design high-impact multimedia content to bring your story to life.

Thought leadership

Across specialist publications, events and awards, Risk.net has an array of trusted channels to build brand awareness and reach your target audience.

Intelligence

Expand your market in the financial services and insurance sectors with inSight accelerator.

Our clients

Numerix is the leading provider of innovative capital markets technology applications and real-time intelligence capabilities for trading and risk management. It drives an open fintech-oriented digital financial services market. Numerix is uniquely positioned in the financial services ecosystem to help its users reimagine operations, modernise business processes and capture profitability.

Archer is a leading provider of integrated risk management solutions that enable customers to improve strategic decision-making and operational resilience with a modern technology platform that supports qualitative and quantitative analysis driven by business and IT impacts.

As pioneers in governance, risk and compliance software, Archer remains solely dedicated to helping customers manage risk and compliance domains, from traditional operational risk to emerging issues such as environmental, social and governance. With more than 20 years in the risk management industry, Archer's customer base represents one of the largest pure risk management communities globally, with over 1,600 deployments, including more than 90 of the Fortune 100.

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration.

ServiceNow provides cloud-based platforms and solutions that help digitise and unify organisations so they can find smarter, faster and better ways of working, and employees and customers can be more connected, innovative and agile.

As society redefines risk and opportunity, OneTrust empowers tomorrow’s leaders to succeed through trust and impact with the Trust Intelligence Platform. The market-defining Trust Intelligence Platform from OneTrust connects privacy, GRC, ethics, and ESG teams, data, and processes, so all companies can collaborate seamlessly and put trust at the center of their operations and culture by unlocking their value and potential to thrive by doing what’s good for people and the planet.

As a leader in analytics, SAS has more than 40 years of experience helping organisations solve their toughest problems. SAS' unrelenting commitment to innovation enables the financial services to modernise and sustain a competitive edge. SAS provides an integrated, enterprise-wide risk management platform for managing risk in an organisation, from strategic to reputational, operational, financial or compliance-related risk management. Learn more about how SAS is driving innovation and business value for risk and finance professionals at www.sas.com/risk.

Moody’s Analytics provides financial intelligence and analytical tools to help business leaders make better and faster decisions. Its risk expertise, expansive information resources and innovative application of technology help its clients confidently navigate an evolving marketplace. Moody’s Analytics offers industry-leading and award-winning solutions, comprising research, data, software and professional services.

Quantifi is a provider of risk, analytics and trading solutions. Its award-winning suite of integrated pre- and post-trade solutions allow market participants to better value, trade and risk manage their exposures. Founded in 2002, Quantifi is trusted by the world’s most sophisticated financial institutions, including five of the six largest global banks, two of the three largest asset managers, leading hedge funds, insurance companies, pension funds and other institutions across 40 countries. By applying the latest technology innovations, Quantifi provides new levels of usability, flexibility, and integration. This translates into dramatically lower time to market, lower total cost of ownership and significant improvements in operational efficiency, allowing clients to focus on their core business.

Coherent provides easy-to-use data pipelines that allow back-end developers to build data back-ends, including machine learning pipelines and indexers. Its datasets provide data points for indexing and creating models

MSCI is a leading provider of critical decision-support tools and services for the global investment community. With over 50 years' expertise in research, data and technology, MSCI powers better investment decisions by enabling clients to understand and analyse key drivers of risk and return, and to confidently build more effective portfolios. MSCI creates industry-leading research-enhanced solutions that clients use to gain insight into and improve transparency across the investment process.

The Protecht Group is a leader in enterprise risk management software and services and enables organisations to achieve their strategic objectives through efficient, effective and agile risk management.

MetricStream is a global software-as-a-service leader of integrated risk management and governance, risk and compliance (GRC) solutions that empower organisations to thrive on risk by accelerating growth via risk-aware decisions. It connects governance, risk management and compliance across the extended enterprise. MetricStream's ConnectedGRC and three product lines – BusinessGRC, CyberGRC and ESGRC – are based on a single, scalable platform that supports clients on their GRC journeys. For more information please click this link www.metricstream.com

RTGS.global makes global cross-border settlement instant, solving risk and liquidity issues with the flexibility to address whatever settlement requires next. Its legal and operational framework and deep industry experience ensures it can deliver technology that fits within company and regulatory requirements.

Beacon Platform is a financial technology firm that provides everything quantitative developers need to rapidly build, test, deploy and share trading and risk applications, analytics and models. Its platform addresses a wide range of needs, from energy and commodity trading to portfolio and multi-asset management, backed by the foundational components needed for a comprehensive view of risk and performance across all assets.

CMC Connect provides multi-asset liquidity provision and tailored trading technology to a global institutional client base of banks, brokerages, funds and dealing desks. Our clients have access to multiple asset classes worldwide allowing them to seamlessly execute their chosen strategy and increase revenue potential. Our continuous innovation and investment in trading technology means that we are able to respond consistently to changing markets.

KWA Analytics is a consultancy with a focus on and experience in implementing trading, risk and treasury management solutions. It is experienced in implementations, upgrades and solution architecture across a range of organisations, and has established itself as a trusted implementation consulting services provider.

ActiveViam delivers a precision analytics platform that improves decision making for complex, real-time, high-volume business and regulatory challenges.

By harnessing existing and new data sources in its high-performance, in-memory aggregation engine, the ActiveViam platform enables train-of-thought analysis, empowering users to delve deeper into key questions.

S&P Global Market Intelligence integrates financial and industry data, research and news into tools that track performance, generate alpha, identify investment ideas, understand competitive and industry dynamics, perform valuation and assess credit risk. It offers investment professionals, government agencies, corporations and universities the intelligence essential to make business and financial decisions with conviction.

Hitachi Energy serves customers in the utility, industry and infrastructure sectors with innovative solutions and services across the value chain. Together with customers and partners, we pioneer technologies and enable the digital transformation required to accelerate the energy transition towards a carbon-neutral future.

We are advancing the world’s energy system to become more sustainable, flexible and secure whilst balancing social, environmental and economic value. Hitachi Energy has a proven track record and unparalleled installed base in more than 140 countries. Headquartered in Switzerland, we employ around 38,000 people in 90 countries and generate business volumes of approximately $10 billion USD.

Jupiter is the global market, science, and technology leader in physical climate analytics for risk management and resiliency planning. Its solutions are used across the private and public sectors including at least one of the world’s five largest firms in asset management, banking, chemicals, insurance, minerals and mining, oil and gas, pension funds, pharmaceuticals, power, and reinsurance. Jupiter services cover a broad range of applications including capital planning, risk management, site selection, design requirements, supply chain management, investment and asset valuations, and shareholder disclosures. Jupiter’s ClimateScore™ Intelligence Platform provides sophisticated, dynamic, hyper local, current hour-to-50-plus-year probabilistic risk analysis for weather in a changing climate. Jupiter’s ClimateScore Global™ services are used for climate-related risk assessment and management worldwide.

OpenGamma is a derivatives analytics firm with expertise in over-the-counter and exchange-traded derivatives margin methodologies, backed by CME, JSCC, Accel and Dawn. It is trusted by large and sophisticated global banks, trading firms and fund managers, with thousands of users depending on its analytics.

Established in 1995, ZE’s sole purpose is to help organizations that are data driven to be more efficient through end-to-end data automation and superior services.

ZE is the developer of ZEMA, a comprehensive platform for data aggregation, validation, modelling, automation and integration. By providing unrivaled data collection, analytics, curve management, and integration capabilities, ZEMA offers robust data solutions for clients in all markets and industries. ZE also provides a full range of support and implementation services ensuring full success across all elements of the organization’s needs. ZEMA is available on premise, as a cloud solution via the ZE Cloud, Software as a Service, or Data-as-a-Service. To learn more visit www.ze.com Data. We Get It.

普华永道 - 中国內地、香港、澳门、台湾及新加坡

普华永道中国內地、香港、澳门、台湾及新加坡成员机构根据各地适用的法律协作运营。整体而言,员工总数约21,000人,其中包括约850名合伙人。

无论客户身在何处,普华永道均能提供所需的专业意见。我们实务经验丰富、高素质的专业团队能聆听各种意见, 帮助客户解决业务问题,发掘并把握机遇。我们的行业专业化有助于就客户关注的领域共创解决方案。

我们分布于以下城市:北京、上海、香港、沈阳、大连、天津、济南、青岛、南京、苏州、杭州、宁波、合肥、郑州、武汉、长沙、西安、成都、重庆、昆明、厦门、广州、深圳、澳门、海口、台北、中坜、新竹、台中、台南、高雄和新加坡。

SeaGlass Technology understands that proactive risk management is crucial in today's rapidly evolving threat landscape. Our team of expert professionals and certified ethical hackers utilize our extensive knowledge and cutting-edge tools to conduct thorough assessments of your IT infrastructure. These assessments go beyond basic security measures, providing a comprehensive view of potential risks and vulnerabilities that may be overlooked.

By engaging SeaGlass Technology for assessments, your firm will gain valuable insights into the current state of your IT security. Our certified ethical hackers delve deep into your systems, networks, and applications, identifying weak points and potential entry points for cyber-attacks. Our expertise allows us to pinpoint vulnerabilities that may otherwise remain hidden, reducing the risk of a security breach.

About LSEG

LSEG (London Stock Exchange Group) is a leading global financial markets infrastructure and data provider, playing a vital social and economic role in the world’s financial system. With our open approach, trusted expertise and global scale, we enable the sustainable growth and stability of our customers and their communities. We are dedicated partners with extensive experience, deep knowledge and a worldwide presence in data and analytics; indices; capital formation; and trade execution, clearing and risk management across multiple asset classes. LSEG is headquartered in the United Kingdom, with significant operations in 70 countries across EMEA, North America, Latin America and Asia Pacific. We employ 23,000 people globally, more than half located in Asia Pacific. LSEG’s ticker symbol is LSEG.

LCH ForexClear, a leading provider of foreign exchange (FX) derivatives clearing, delivers unmatched capital and operational efficiencies. Built in partnership with the market and with the benefit of LCH’s extensive experience in interest rate swaps clearing, ForexClear’s 24-hour FX clearing service offers industry-leading risk management for deliverable FX forwards, spot and options, non-deliverable forwards and non-deliverable options, across multiple emerging market and G10 currency pairs. LCH is an LSEG business.

Nasdaq is a global technology company serving the capital markets and other industries. Its data, analytics, software and services offerings enable clients to optimise and execute their business visions with confidence. Nasdaq is the world’s largest capital markets infrastructure technology provider, powering one in 10 of securities transactions globally. Nasdaq's market technology powers more than 250 market infrastructure organisations and market participants – including broker-dealers, exchanges, clearing houses, central securities depositories and regulators – in over 50 countries with end-to-end mission-critical technology solutions.

Tradeweb Markets is a leading global operator of electronic marketplaces for rates, credit, equities and money markets. Founded in 1996, Tradeweb provides access to markets, data and analytics, electronic trading, straight-through processing and reporting for more than 40 products to clients in the institutional, wholesale and retail markets. Advanced technologies developed by Tradeweb enhance price discovery, order execution and trade workflows while allowing for greater scale and helping to reduce risks in client trading operations. Tradeweb serves approximately 2,500 clients in more than 65 countries. On average, Tradeweb facilitated more than $1 trillion in notional value traded per day over the past four quarters. For more information, visit www.tradeweb.com.

Fusion Risk Management is a leading industry provider of cloud-based software solutions for operational resilience, encompassing risk management, third-party risk management, IT and security risk, business continuity and disaster recovery, and crisis and incident management. Its products and services take organisations beyond legacy solutions and empower them to make data-driven decisions with a comprehensive and flexible approach through one system. Fusion and its team of experts are dedicated to helping companies achieve greater operational resilience and mitigate risks within their businesses.

NICE Actimize, the industry’s largest and broadest provider of financial crime, anti-money laundering, enterprise fraud and compliance solutions is the leader in autonomous financial crime management. The autonomous journey begins with NICE Actimize’s ActOne, which fundamentally transforms financial crime investigations by introducing intelligent automation and visual storytelling for speed and accuracy. Intelligent automation saves time by enabling a virtual workforce of robots to collaborate with human investigators, while visual storytelling uncovers more risks by showing relationships between entities, alerts and cases in a visual manner. The autonomous path continues with the release of X-Sight, NICE Actimize’s cloud-based financial crime risk management platform-as-a-service, which breaks the limits on data and analytics by leveraging the cloud. Get in touch at info@niceactimize.com.

With the unique combination of financial services, technology and regulatory expertise, IBM RegTech enables institutions to make more timely and risk-aware decisions. We apply the latest advancements in artificial intelligence, machine learning and automation to the risk and compliance process, increasing operational efficiency, accelerating insight and improving transparency. This greater oversight and understanding helps our clients preserve institutional trust and enhance value to their shareholders and customers alike.

To learn more about IBM financial crime and regulatory compliance solutions, visit ibm.com/RegTech and follow us on Twitter @IBMFintech

Oracle is a cloud technology company that provides organisations worldwide with computing infrastructure and software to help them innovate, unlock efficiencies and become more effective. Oracle Cloud Infrastructure offers higher performance, security and cost savings, and is designed to move workloads easily from on-premises systems to the cloud. Millions of people use Oracle's tools to streamline supply chains, make HR more human, quickly pivot to a new financial plan and connect data and people around the world.

For nearly four decades, State Street Global Advisors has been committed to helping financial professionals and those who rely on them achieve their investment objectives. We partner with institutions and financial professionals to help them reach their goals through a rigorous, research-driven process spanning both active and index disciplines. We take pride in working closely with our clients to develop precise investment strategies, including our pioneering family of SPDR ETFs. With millions* in assets under management, our scale and global footprint provide access to markets and asset classes, and allow us to deliver expert insights and investment solutions.

State Street Global Advisors is the investment management arm of State Street Corporation.

* Assets under management were $2.51 trillion as of December 31, 2018. AUM reflects approx. $32.45 billion (as of December 31, 2018) with respect to which State Street Global Advisors Funds Distributors, LLC (SSGA FD) serves as marketing agent; SSGA FD and State Street Global Advisors are affiliated.